Ever stood in the grocery store aisle, staring blankly at shelves of pasta sauce, unsure which one to pick? Too many choices can feel overwhelming. Funny enough, investing often feels the same way.

We have thousands of stocks at our fingertips, each with its own story, promise, and risk. How do you choose without getting a headache?

Let’s talk about a tool that can help simplify this conundrum: K-Means Clustering. But don’t let the fancy name scare you off. It’s like organizing your messy garage — but for stocks.

The Paradox of Choice in Investing

Remember when there were just a few channels on TV? Now, with hundreds of options, finding something to watch can take longer than the show itself. In investing, more choices don’t always make things easier or better.

We often believe that more information leads to better decisions. But sometimes, it just leads to analysis paralysis.

Grouping Stocks Like Sorting Socks

Imagine dumping a laundry basket full of socks on your bed. They’re all mixed up — different colors, patterns, sizes. The quickest way to sort them? Group similar ones together.

That’s essentially what K-Means Clustering does with stocks. It groups companies that share similar characteristics — like historical returns and volatility — so you can make sense of the scene.

Why Clustering Matters

When we group stocks:

- Diversification Becomes Manageable: Instead of picking randomly, you can choose stocks from different groups, reducing the risk of them all sinking at once.

- Spotting the Outliers: Ever notice one sock that doesn’t match any other? In finance, that might be an undervalued stock waiting for attention.

- Simplifying Decisions: Fewer groups mean fewer choices, making the investing process more manageable.

A Simple Guide to Clustering Stocks with Python

Now, I’m not assuming you’re a programming pro. But stick with me — this is easier than assembling that DIY furniture you bought last month.

Step 1: Gather Your Tools

You’ll need Python and a few libraries.

import pandas as pd

import numpy as np

from sklearn.cluster import KMeans

import matplotlib.pyplot as plt

import yfinance as yf

Step 2: Get the Data

Imagine you’re collecting ingredients for a recipe. Here, we’re grabbing historical returns and volatility for a bunch of stocks.

To gather stock data, we use the yfinance Python library, enabling us to download the returns of 40 different stocks.

# Define the list of stock tickers you want to analyze

tickers = [

'AAPL', 'MSFT', 'GOOGL', 'AMZN', 'TSLA', 'META', 'NVDA', 'BRK-B', 'JPM', 'JNJ',

'V', 'PG', 'UNH', 'DIS', 'PYPL', 'NFLX', 'KO', 'PEP', 'ADBE', 'CSCO', 'INTC', 'IBM', 'ORCL', 'CSX', 'BA', 'XOM', 'CVX', 'T', 'VZ', 'NKE',

'MCD', 'SBUX', 'WMT', 'HD', 'LOW', 'COST', 'PFE', 'MRK', 'ABBV', 'MDT'

]

# Download historical data for these tickers

data = yf.download(tickers, period='2y')

# Calculate daily returns

daily_returns = data['Adj Close'].pct_change().dropna()

# Calculate annualized returns and volatility

annual_returns = daily_returns.mean() * 252 # Assuming 252 trading days in a year

annual_volatility = daily_returns.std() * np.sqrt(252)

# Create a DataFrame with the computed returns and volatility

stock_data = pd.DataFrame({

'Stock': annual_returns.index,

'Returns': annual_returns.values,

'Volatility': annual_volatility.values

})

# Display the stock data

print(stock_data)

# Prepare features for clustering or further analysis

features = stock_data[['Returns', 'Volatility']]

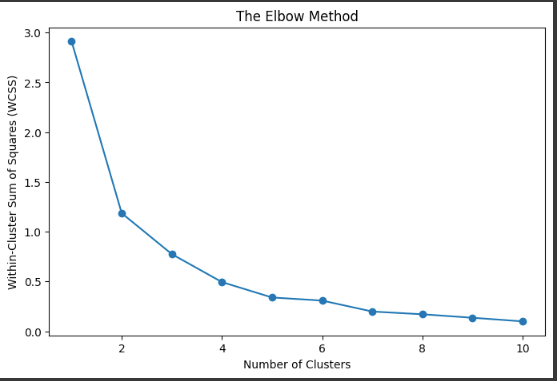

Step 3: Find the Right Number of Groups

Too many clusters, and it’s like sorting socks by shade instead of color — too granular. Too few, and you might as well not sort at all.

wcss = []

for i in range(1, 11):

kmeans = KMeans(n_clusters=i)

kmeans.fit(features)

wcss.append(kmeans.inertia_)

# Plotting the Elbow Method graph

plt.figure(figsize=(8,5))

plt.plot(range(1, 11), wcss, marker='o')

plt.xlabel('Number of Clusters')

plt.ylabel('Within-Cluster Sum of Squares (WCSS)')

plt.title('The Elbow Method')

plt.show()

You’ll look for the “elbow” in the chart — the point where adding another cluster doesn’t significantly improve things.

Step 4: Cluster the Stocks

Let’s say the elbow tells us to go with four clusters.

# Perform KMeans clustering

kmeans = KMeans(n_clusters=4, random_state=42)

stock_data['Cluster'] = kmeans.fit_predict(features)

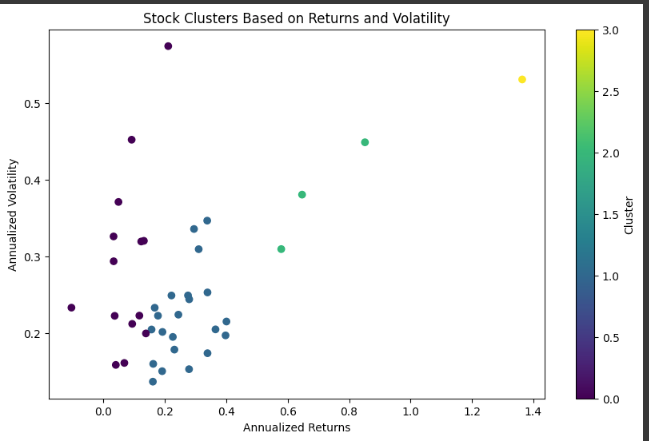

Step 5: See the Results

Now, let’s peek at how our stocks are grouped.

# Plot clusters

plt.figure(figsize=(10, 6))

plt.scatter(stock_data['Returns'], stock_data['Volatility'], c=stock_data['Cluster'], cmap='viridis')

plt.xlabel('Annualized Returns')

plt.ylabel('Annualized Volatility')

plt.title('Stock Clusters Based on Returns and Volatility')

plt.colorbar(label='Cluster')

plt.show()

You should see your stocks grouped into clusters — like sorted socks ready to be paired.

Does Diversification Across Clusters Really Help?

Let’s put our clustering to the test. Suppose we want to see how diversifying across different clusters affects our portfolio compared to randomly picking stocks from the same cluster or at random.

We’ll simulate portfolios and compare their maximum drawdowns.

What’s Drawdown?

Drawdown measures the peak-to-trough decline during a specific period. In simple terms, it’s how much your portfolio could fall from its highest value before recovering.

Simulating Portfolios

Let’s create two portfolios:

- Diversified Portfolio: Stocks chosen from different clusters.

- Same Cluster Portfolio: Stocks chosen from the same cluster.

We’ll then simulate their returns over time.

# Function to calculate maximum drawdown

def calculate_max_drawdown(cumulative_returns):

running_max = np.maximum.accumulate(cumulative_returns)

drawdowns = (cumulative_returns - running_max) / running_max

max_drawdown = drawdowns.min()

return max_drawdown

# Select one stock from each cluster randomly for diversified portfolio

diversified_stocks = stock_data.groupby('Cluster').apply(lambda x: x.sample(1)).reset_index(drop=True)

diversified_returns = daily_returns[diversified_stocks['Stock']]

# Calculate cumulative returns for diversified portfolio

diversified_cum_returns = (1 + diversified_returns).cumprod()

# Calculate max drawdown for diversified portfolio

diversified_max_drawdown = diversified_cum_returns.apply(calculate_max_drawdown)

# Select four stocks from the same cluster randomly

cluster_choice = 0

same_cluster_stocks = stock_data[stock_data['Cluster'] == cluster_choice].sample(4)

same_cluster_returns = daily_returns[same_cluster_stocks['Stock']]

# Calculate cumulative returns for same-cluster portfolio

same_cluster_cum_returns = (1 + same_cluster_returns).cumprod()

# Calculate max drawdown for same-cluster portfolio

same_cluster_max_drawdown = same_cluster_cum_returns.apply(calculate_max_drawdown)

# Print results

print("Diversified Portfolio Max Drawdown:")

for stock, mdd in diversified_max_drawdown.items():

print(f"{stock}: {mdd:.2%}")

print(f"Average Drawdown: {diversified_max_drawdown.mean():.2%}")

print("\nSame Cluster Portfolio Max Drawdown:")

for stock, mdd in same_cluster_max_drawdown.items():

print(f"{stock}: {mdd:.2%}")

print(f"Average Drawdown: {same_cluster_max_drawdown.mean():.2%}")

# Compare differences

difference = diversified_max_drawdown.mean() - same_cluster_max_drawdown.mean()

print(f"\nDifference in average max drawdown: {difference:.2%}")def max_drawdown(portfolio):

cumulative_max = np.maximum.accumulate(portfolio)

drawdowns = (portfolio - cumulative_max) / cumulative_max

return drawdowns.min()

diversified_drawdown = max_drawdown(diversified_portfolio)

same_cluster_drawdown = max_drawdown(same_cluster_portfolio)

random_drawdown = max_drawdown(random_portfolio)

print(f"Diversified Portfolio Max Drawdown: {diversified_drawdown:.2%}")

print(f"Same Cluster Portfolio Max Drawdown: {same_cluster_drawdown:.2%}")

print(f"Random Portfolio Max Drawdown: {random_drawdown:.2%}")

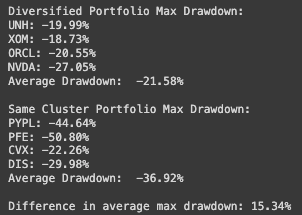

Comparing the Results

Let’s see how these portfolios performed over the year.

"Diversified Portfolio Max Drawdown": -21.58%

"Same Cluster Portfolio Max Drawdown": -36.92%

"Difference in average max drawdown": 15.34%

The Exaggerated Impact of Diversification

In our example, the Diversified Portfolio had a maximum drawdown of 22%, while the Same Cluster Portfolio suffered a whopping 37% decline.

That’s a significant difference. By choosing stocks from different clusters, we mitigated the risk of a severe downturn.

Why Such a Big Difference?

When you pick stocks from the same cluster, they’re more likely to move together. If one stock drops, the others might follow suit — like dominoes. Diversifying across clusters means your stocks are less correlated; they respond differently to market events.

If you’re interested in investing in stocks within the same group, consider using the pair trading strategy. We’ve discussed this approach in detail in our previous blogs, which you can explore here.

Turning Data into Decisions

So, what does this mean for you?

- Risk Management: Diversifying across different clusters can protect your portfolio from extreme losses.

- Informed Choices: Clustering helps you understand the underlying similarities and differences between stocks.

- Peace of Mind: Knowing that your portfolio isn’t overly exposed to a single type of stock or market movement can help you sleep better at night.

The Human Side of Investing

Behind every data point is a story. Companies are run by people, influenced by markets, and affected by events we can’t predict.

Clustering helps us manage the data avalanche, but it doesn’t replace understanding a company’s fundamentals or the emotions driving market behavior.

Remember when toilet paper flew off the shelves in 2020? It wasn’t because people suddenly needed more — it was fear and herd behavior. Stocks can behave the same way.

Finding Your Own Path

Investing isn’t about copying someone else’s strategy. It’s about finding what works for you. Tools like K-Means Clustering are just that — tools. They help you craft your approach.

Maybe you prefer diving deep into a company’s annual reports. Or perhaps you rely on trends and charts. There’s no one-size-fits-all, and that’s okay.

Wrapping Up

Next time you’re faced with too many choices — whether it’s stocks, pasta sauce, or what to watch tonight — remember that grouping can bring clarity.

By breaking down complex options into manageable categories, we can make decisions with more confidence and less stress.

Investing doesn’t have to be a labyrinth. Sometimes, it’s as simple as sorting socks.

Additional Resources

We also offer a variety of free indicators and a premium indicator available for trial at no cost.

If you appreciate our strategy and insights, please help us grow by following our page and trying out our indicators.

To discover more about TradeDots, please glance through our comprehensive documentation with the link below: https://docs.tradedots.xyz/

🖥️ Get TradeDots Indicator: https://bit.ly/tradedots

📈 [Download] High Growth Alpha Stock List: https://bit.ly/tradedots-alphalist

📃 [Download] 2024 Forex Trading Journal: https://bit.ly/2024-trading-journal

Stay connected for more insightful blogs and updates, and join our telegram community for free trading ideas and stock watch alerts.

Twitter: https://twitter.com/tradedots

YouTube: https://youtube.com/@tradedots/

Telegram: https://t.me/tradedots_official

About TradeDots

TradeDots is a TradingView indicator that identifies market reversal patterns through the implementation of quantitative trading algorithm on price actions. Try our 7-day FREE Trial to level up your trading game.

Join us now to experience TradeDots across all trading assets!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risks, and it’s important to conduct your own research or consult with a financial professional before making investment decisions.

.png)