I once met a man who could juggle chainsaws. Real, roaring chainsaws. I asked him how he stays so calm with so much risk flying around. He smiled and said, “I focus on balancing the weight. If I do that, the chainsaws take care of themselves.”

Investing can feel a lot like juggling chainsaws, can’t it? Markets swirl, prices leap, and before you know it, you’re trying to catch a falling blade. But what if there was a way to balance the weight in your portfolio, so the risks took care of themselves?

That’s where delta hedging comes in. And with a bit of Python magic, it’s more accessible than you might think.

The Balancing Act of Delta Hedging

Delta hedging sounds complex, but at its heart, it’s about balance. It’s a strategy used to reduce the directional risk of an investment by offsetting positions. Imagine you’re holding an option on a stock; delta hedging helps you balance out the risk of the stock price moving up or down.

Think of it like adjusting the sails on a boat. If the wind changes direction, you tweak the sails to keep moving forward smoothly. Delta hedging tweaks your investment positions to keep your financial boat steady, no matter which way the market winds blow.

Why Should You Care About It?

Ever lay awake at night worried about your investments? Delta hedging is like a financial sleep aid. It helps you:

- Manage Risk: By neutralizing price movements, you can protect against sudden market swings.

- Stay Calm in Volatile Markets: When others panic, you have a plan.

- Make Informed Decisions: Understanding hedging gives you more control over your financial destiny.

Remember, investing isn’t just about chasing returns; it’s about managing risks so the returns you get are ones you can keep.

Let’s Break It Down: Key Concepts

Before we dive into code and numbers (I promise we’ll keep it simple), let’s get comfortable with some basics.

1. Options 101

An option gives you the right, but not the obligation, to buy or sell an asset at a set price before a certain date. There are two types:

- Call Option: The right to buy.

- Put Option: The right to sell.

2. What’s Delta

In the world of options, delta measures how much the price of an option changes when the underlying asset’s price changes. If a call option has a delta of 0.5, and the stock price increases by $1, the option’s price increases by about $0.50.

Delta values range:

- Call Options: Between 0 and 1.

- Put Options: Between -1 and 0.

Understanding delta is like knowing how sensitive your car’s gas pedal is. Press a little, and how much does the speed increase?

Rolling Up Our Sleeves: Building Your Delta Hedging Strategy with Python

Don’t worry if you’re not a programming whiz. Python is like the Swiss Army knife of coding — versatile and user-friendly.

Step 1: Setting Up Shop

First things first, we’ll need some tools. Install Python on your computer if you haven’t already. Then, we’ll use some handy libraries:

- Pandas: For handling data.

- NumPy: For crunching numbers.

- Matplotlib: For visualizing.

- yfinance: To grab stock data.

- SciPy: For statistical functions.

Open your command prompt or terminal and run:

pip install pandas numpy matplotlib yfinance scipy

Step 2: Gathering the Essentials

Let’s import what we need.

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import yfinance as yf

from scipy.stats import norm

Step 3: Choosing Your Player

Pick a stock you like. For this example, let’s go with Apple (AAPL). It’s a company we all know, and it’s got plenty of data.

# Stock ticker symbol

ticker = 'AAPL'

# Fetch historical data

data = yf.download(ticker, start='2023-01-01', end='2023-12-31')

# Look at the first few rows

print(data.head())

Step 4: Calculating Delta

Here’s where the magic happens. We’ll use the Black-Scholes model to calculate delta.

The formula might look scary, but think of it as a recipe for options trading. Each ingredient plays its part.

def black_scholes_delta(S, K, T, r, sigma, option_type='call'):

"""

Calculate the Black-Scholes delta for a call or put option.

"""

d1 = (np.log(S / K) + (r + 0.5 * sigma **2) * T) / (sigma * np.sqrt(T))

if option_type == 'call':

delta = norm.cdf(d1)

else: # put option

delta = -norm.cdf(-d1)

return delta

Step 5: Setting the Scene

Let’s define our variables.

import datetime

# Current stock price

S = data['Close'][-1]

# Strike price (we'll keep it simple and use the current price)

K = S

# Time to expiration (in years)

T = 30 / 365 # 30 days

# Risk-free interest rate

r = 0.01 # That's 1%

# Volatility (annualized standard deviation)

sigma = data['Close'].pct_change().std() * np.sqrt(252)

# Option type ('call' or 'put')

option_type = 'call'

Step 6: Finding Delta

Now, let’s calculate the delta.

delta = black_scholes_delta(S, K, T, r, sigma, option_type)

print(f"Delta of the option: {delta:.4f}")

This number tells us how sensitive our option is to the stock price.

Step 7: Hedging Your Position

Suppose you own 10 call option contracts (each contract typically represents 100 shares). To hedge, you’d sell shares of the stock to offset.

# Number of option contracts

num_options = 10

# Total delta

total_delta = delta * num_options * 100 # 100 shares per contract

print(f"Sell {total_delta:.0f} shares to hedge your position.")

This means if the stock price moves, the gain or loss on your option position is offset by the opposite movement in the stock position.

Keeping the Balance: Adjusting Over Time

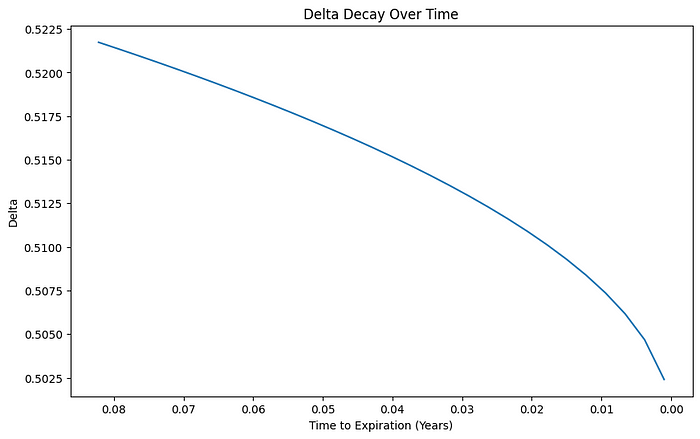

Markets aren’t static, and neither is delta. As time passes and prices change, so does delta. This means our hedge needs a tune-up now and then — just like adjusting those sails when the wind shifts.

Step 8: Simulating the Journey

Let’s simulate how delta changes over time.

# Time steps (daily)

time_steps = np.linspace(T, 0.001, int(T * 365))

# Lists to store results

deltas = []

times = []

for t in time_steps:

times.append(t)

delta_t = black_scholes_delta(S, K, t, r, sigma, option_type)

deltas.append(delta_t)

# Plotting delta over time

plt.figure(figsize=(10,6))

plt.plot(times, deltas)

plt.title('Delta Decay Over Time')

plt.xlabel('Time to Expiration (Years)')

plt.ylabel('Delta')

plt.gca().invert_xaxis() # Time decreases towards expiration

plt.show()

This graph shows how delta changes as we get closer to the option’s expiration date.

What Does This Mean for You?

Delta hedging isn’t a set-it-and-forget-it strategy. It’s more like tending a garden. You plant the seeds, but you need to water and weed regularly.

Here’s what to keep in mind:

- Stay Vigilant: Regularly check your delta and adjust your hedge as needed.

- Mind the Costs: Every adjustment can incur transaction fees. Balance the benefits with the costs.

- Understand the Limits: Hedging can reduce risk, but it doesn’t eliminate it.

Lessons from the Juggler

Remember our chainsaw juggler? He didn’t start with running chainsaws. He began with juggling balls, then moved to pins, before ever touching a chainsaw. The point is, he built up his skills over time.

Delta hedging is the same. Start small. Get comfortable with the concepts and the mechanics. Use paper trading accounts to practice without risking real money.

Final Thoughts

Investing isn’t about predicting the future; it’s about preparing for it. Delta hedging is one way to prepare for the unknown by balancing your risk.

By using Python, you have a powerful tool at your fingertips. It allows you to automate and analyze, giving you insights that were once only available to big institutions.

Your Next Move

Curious to see how this works with different stocks or options? Try changing the variables in the code. See how volatility or time to expiration affects delta.

Ask yourself:

- What if I adjust the strike price?

- How does a put option compare to a call?

- What happens when volatility increases?

Experimentation leads to understanding.

Additional Resources

We also offer a variety of free indicators and a premium indicator available for trial at no cost.

If you appreciate our strategy and insights, please help us grow by following our page and trying out our indicators.

To discover more about TradeDots, please glance through our comprehensive documentation with the link below: https://docs.tradedots.xyz/

🖥️ Get TradeDots Indicator: https://bit.ly/tradedots

📈 [Download] High Growth Alpha Stock List: https://bit.ly/tradedots-alphalist

📃 [Download] 2024 Forex Trading Journal: https://bit.ly/2024-trading-journal

Stay connected for more insightful blogs and updates, and join our telegram community for free trading ideas and stock watch alerts.

Twitter: https://twitter.com/tradedots

YouTube: https://youtube.com/@tradedots/

Telegram: https://t.me/tradedots_official

About TradeDots

TradeDots is a TradingView indicator that identifies market reversal patterns through the implementation of quantitative trading algorithm on price actions. Try our 7-day FREE Trial to level up your trading game.

Join us now to experience TradeDots across all trading assets!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risks, and it’s important to conduct your own research or consult with a financial professional before making investment decisions.

.png)